Trust Administration for Clients Across Murrieta, CA; Temecula, CA; San Diego, CA; & Beyond

If you’ve been named the trustee in the administration of an estate, you may have a lot of questions about your responsibilities. Our experienced trust attorney can help.

I Was Named as Trustee of a Trust. Does Everything Happen Automatically?

Unfortunately, nothing is automatic, even if your friend, relative, or loved one created a trust. In order to be placed in charge of the trust as trustee, you will need to follow certain steps, including locating and reviewing the original trust and obtaining certified copies of the death certificate, creating an inventory of the trust’s assets and determining their value, and notifying all beneficiaries and heirs. While the probate court is not in charge of the administration of the trust, you will need to fulfill your fiduciary duty and follow the requirements of the California probate code as the trustee. When you need the assistance of experienced trust attorneys in San Diego, CA and the surrounding areas, contact the team at The Ashcraft Firm. We can get you connected with a trust attorney to help you navigate this process.

Do I Need a Trust Attorney to Help Me Navigate Trust Administration?

While you aren’t strictly required to use an attorney to help you through the process of administering a trust, there are many reasons you might want to consult a trust attorney as you perform your duties as trustee.

Fiduciary Duty

As we mentioned, a trustee needs to fulfill their fiduciary duty, which means that you can be sued if you do not perform your duties as a trustee properly, but a trust attorney can protect you from personal liability. A trust attorney will ensure that the trust is administered according to the law by providing legal advice, interpreting trust provisions, clarifying ambiguous terms, and ensuring the proper management and distribution of assets.

Time Is Money

Learning the process may take time, and waiting even a few months can cost the estate big time. Let’s take, for instance, a home with a mortgage. If there is a home held in the trust and you are required to sell the property in order to split up the assets of the trust, you may waste a lot of time because you did not communicate your role in the sale of the home properly. If you are forced to pay more property tax and mortgage payments that you wouldn’t have had to pay because you didn’t know what you were doing, you may have violated your duty to protect the assets of the trust.

Probate Code Requirements

The probate code has many requirements. For instance, you are required to send a specific notice to the beneficiaries of the trust when a portion of the trust becomes “irrevocable.” Irrevocable means that a portion of the trust becomes unchangeable. A trust, or a portion of a trust, typically becomes irrevocable when someone dies. This means that you are required to send out a specific notice to the beneficiaries of the trust when your loved one passes away. How are you supposed to know what is required of you by law? You could do a lot of research, or you can consult an attorney. You don't know what you don't know, and hopefully it is not too late then.

The short answer to whether you have to hire a trust attorney to help you is no. However, many choose to get help because the costs of doing it incorrectly could include a lawsuit where your personal assets are at stake. Further, hiring a trust lawyer costs you nothing because these are considered expenses of the estate and are paid by the estate after the trust administration process has concluded. Unlike hiring a trust lawyer after the death of a loved one, a living trust attorney can help you transfer assets of the estate prior to your family member passing.

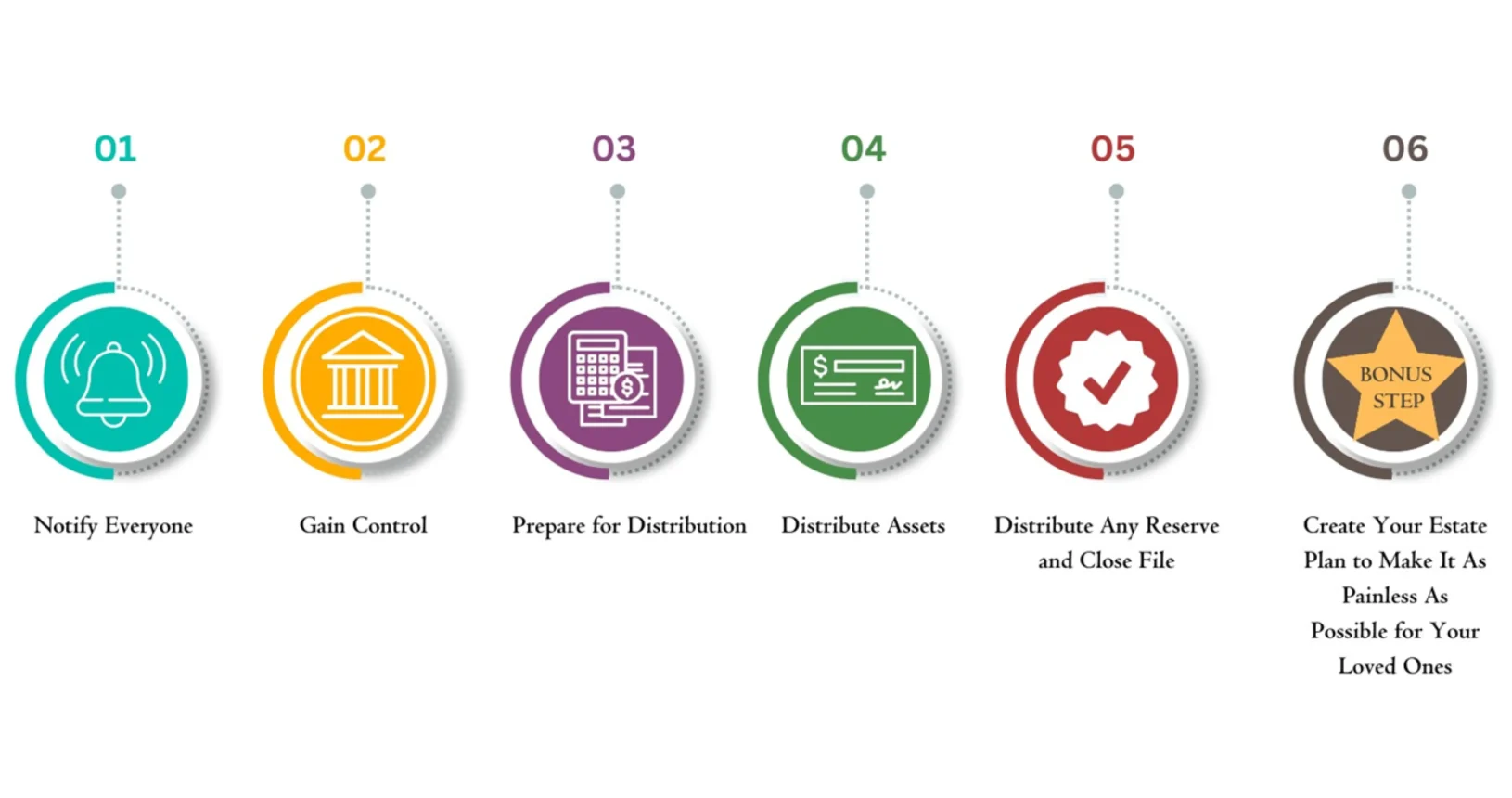

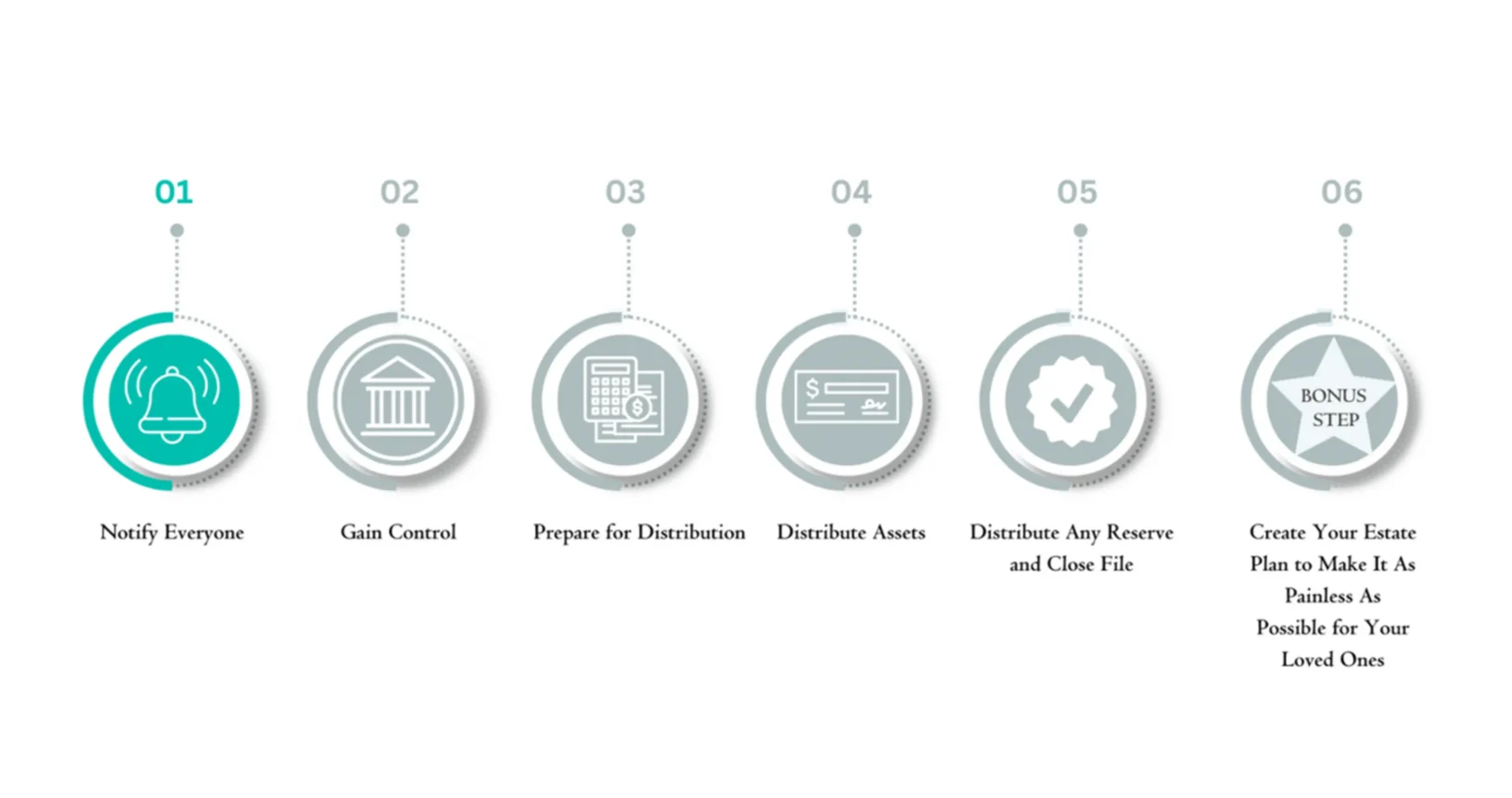

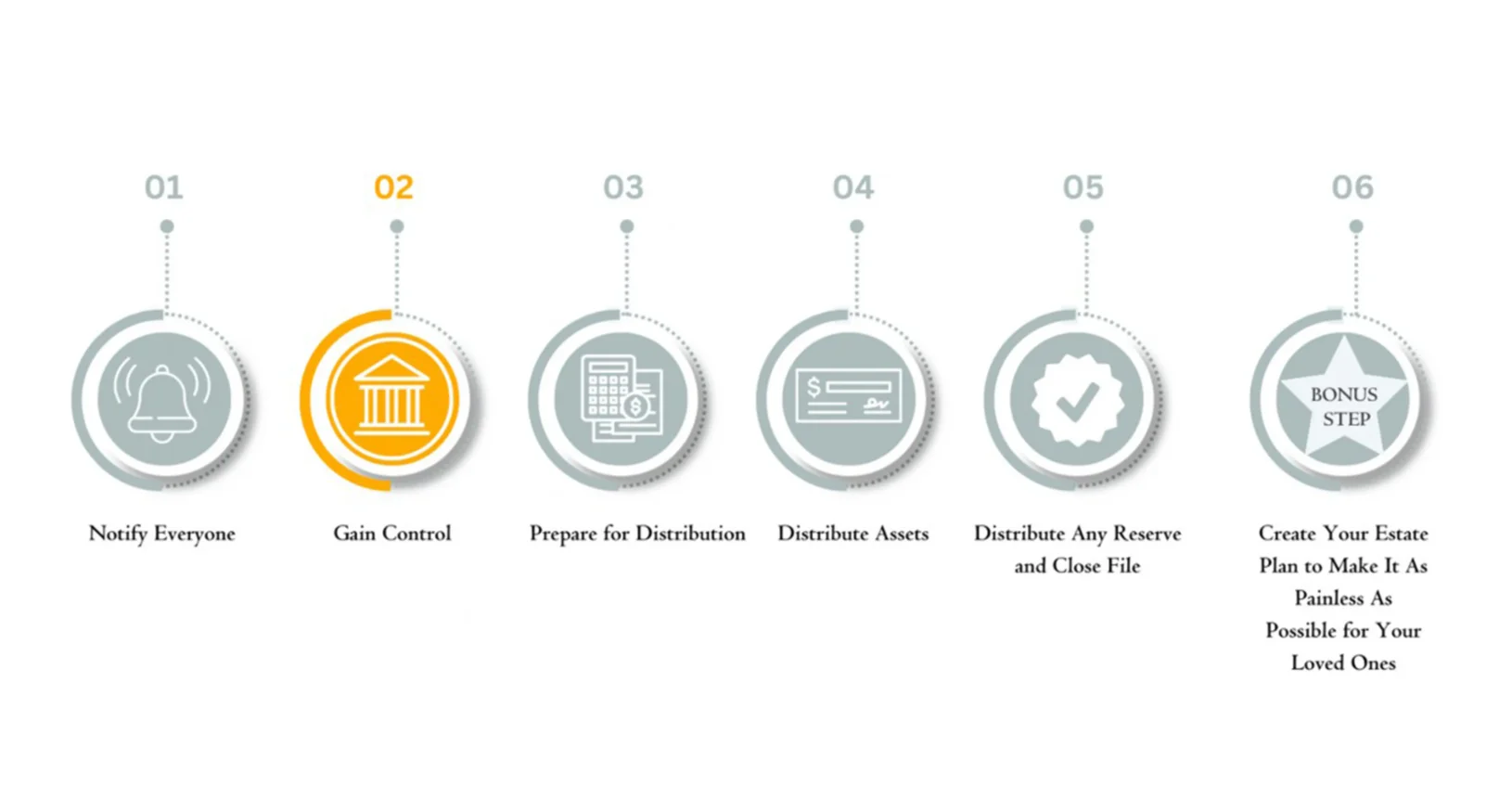

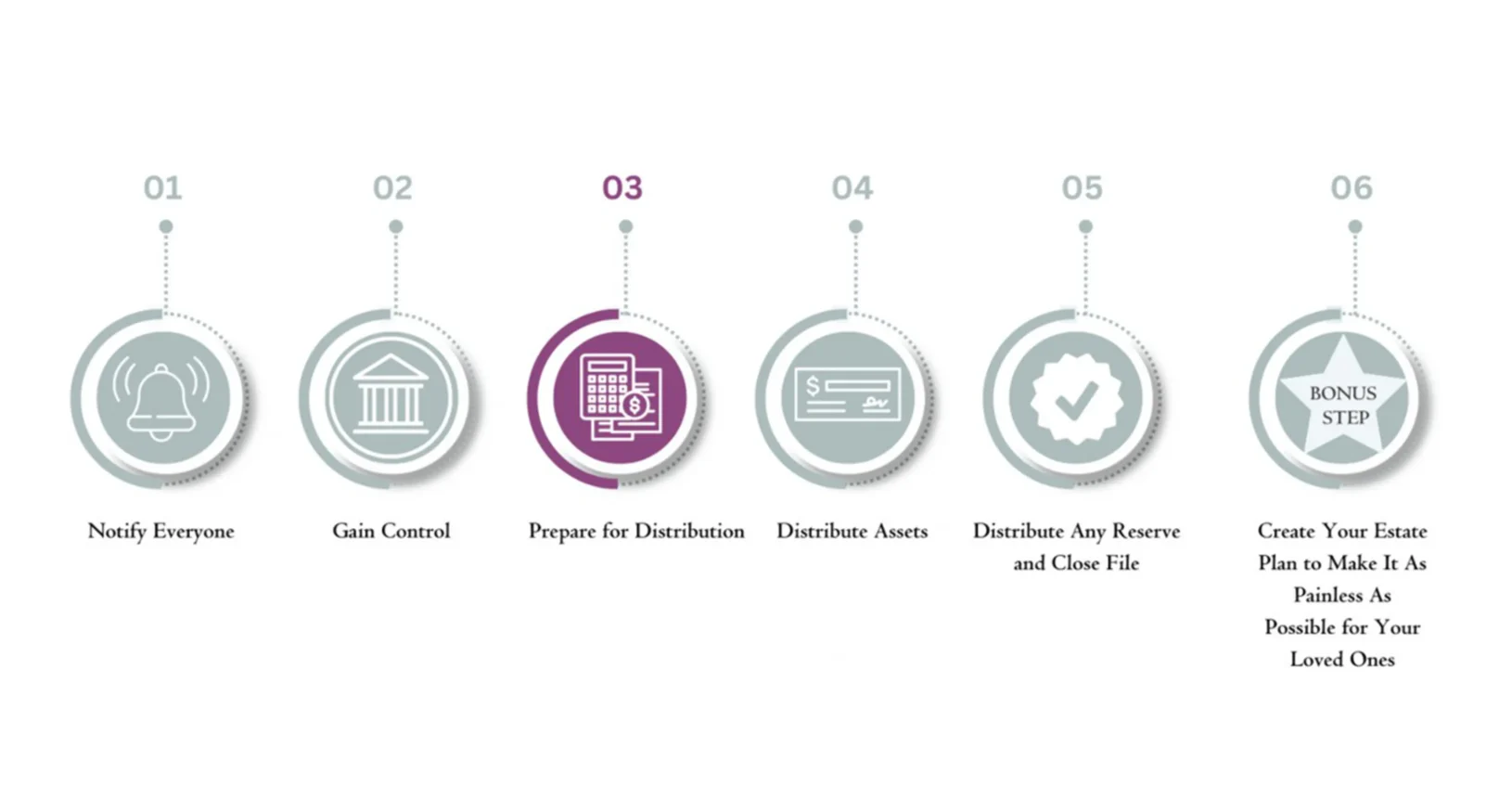

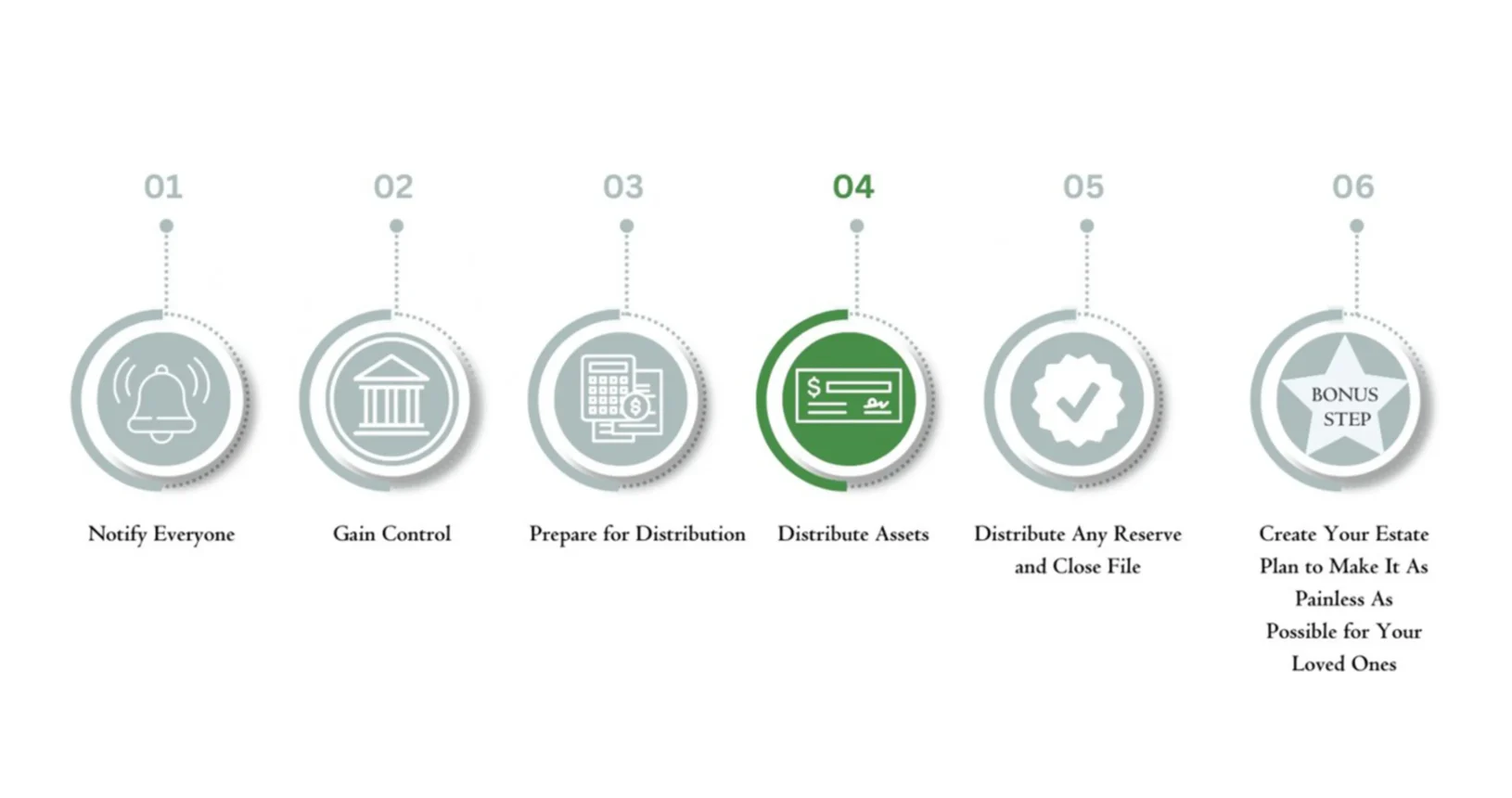

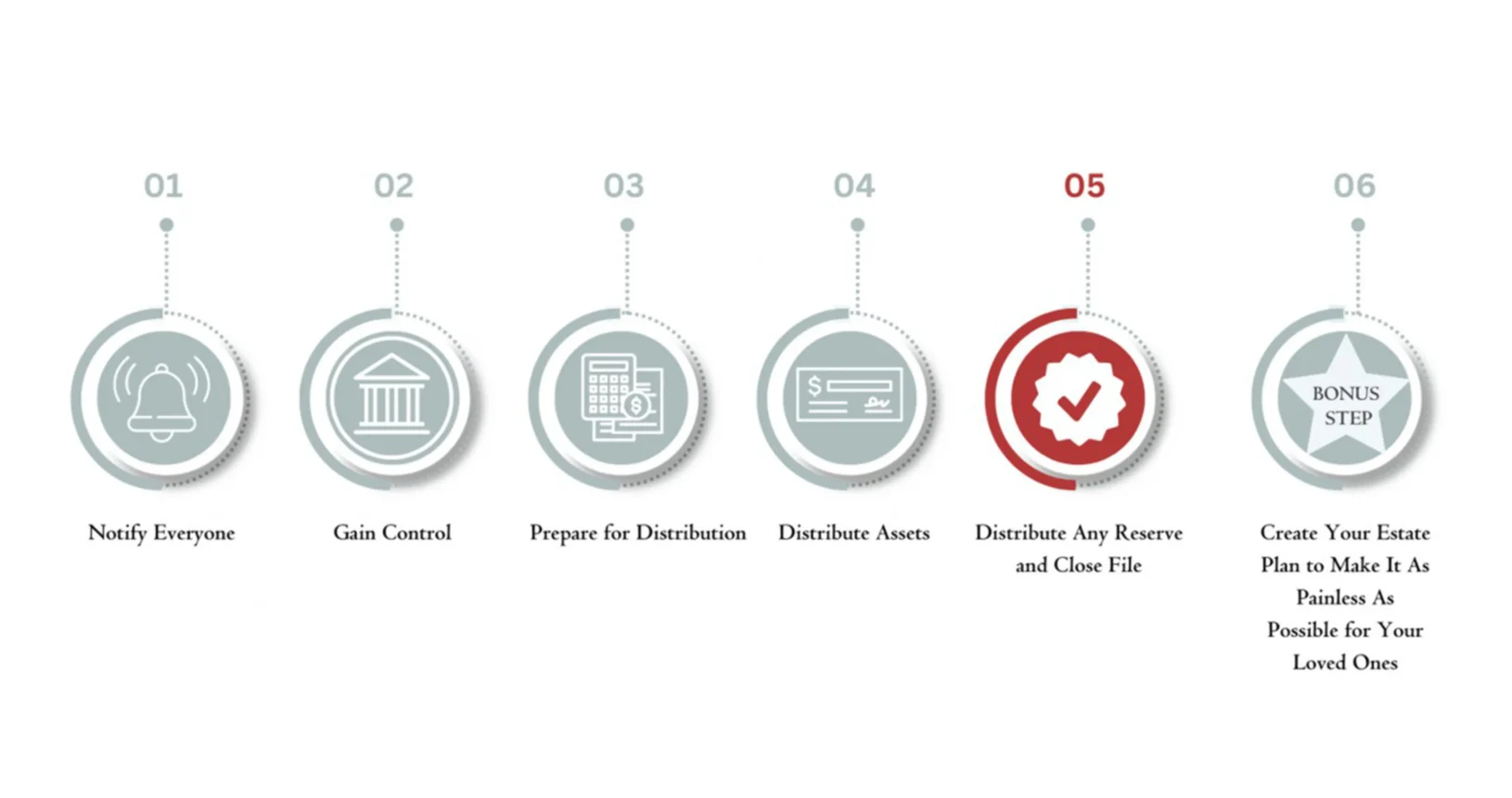

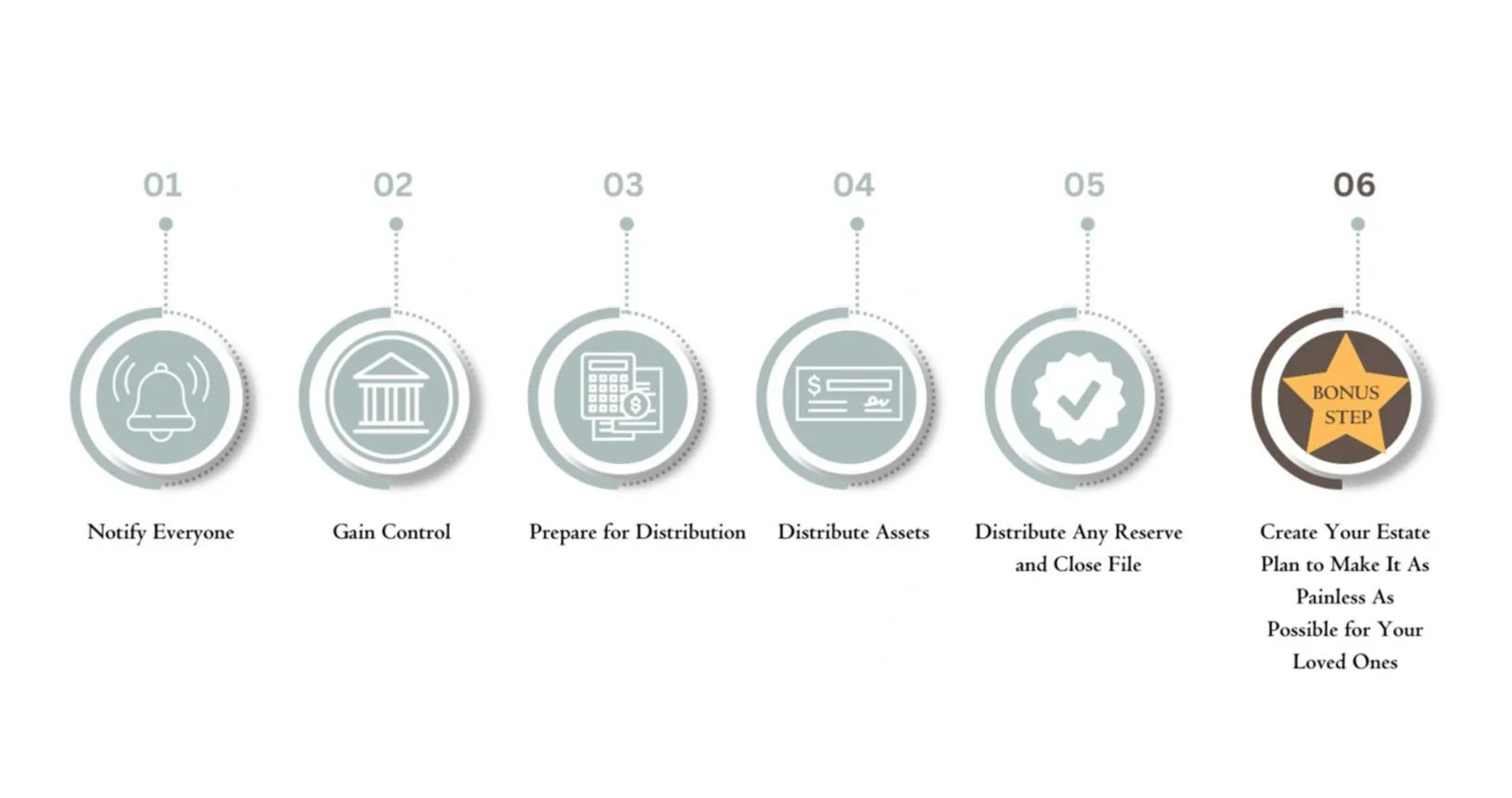

How Does a Trust Work After Someone Dies?

Contact Us Today to Learn More

To learn more about our trust administration options, we welcome you to contact the team at The Ashcraft Firm. We are proud to serve individuals and families throughout Murrieta, CA; Temecula, CA; Menifee, CA; Hemet, CA; Lake Elsinore, CA; Moreno Valley, CA; Palm Springs, CA; Perris, CA; Poway, CA; Riverside, CA; Rancho Bernardo, CA; and the surrounding areas.