Probate Lawyers Serving Clients in Murrieta, CA; Temecula, CA; San Diego, CA; & Beyond

At The Ashcraft Firm, we are so excited to introduce our $0 down probate program to Riverside County Executors. This means that you can be represented by an experienced probate attorney without paying any attorney’s fees upfront. We will wait to get our fees when the estate is in a position to pay for those fees itself. If you are as excited as we are, please feel free to contact one of our will and estate lawyers now, and we can start the process today by scheduling an initial gathering phone call with a probate paralegal who will gather all the information probate court and attorneys will need to get your case finalized. We are proud to be your local source of probate law representation and trust administration in Murrieta, CA; Temecula, CA; Menifee, CA; Hemet, CA; Lake Elsinore, CA; Moreno Valley, CA; Palm Springs, CA; Perris, CA; Poway, CA; Riverside, CA; Rancho Bernardo, CA; and the surrounding areas.

What is Probate?

Probate law is essentially the court process that returns property to the land of the living. A lot of people think that probate law refers to a tax. There are taxes that may come due at death, but this is a completely separate issue (you can find out more about taxes at death here). If you do nothing to plan your estate, the court may get involved in implementing a plan that the State of California has for you. If you need assistance with probate law in the Murrieta or San Diego, CA area, look no further than The Ashcraft Firm.

How Is Property Transferred After Death?

After a loved one passes away, you may or may not have to go to probate court. The first thing to understand is that the court looks just at the “estate” that your loved one left when they passed away. To determine what is actually in your loved one's estate, you have to understand the four ways to pass property at death: (1) by joint tenancy, (2) by contract, (3) through trust, and (4) through your estate.

Joint Tenancy

One way that many pass property is by joint tenancy. The full name is actually Joint Tenancy with Right of Survivorship. When you hold property as joint tenants, and a tenant (one of the owners) passes, the property automatically transfers to the surviving tenants without any probate court involvement. Now, before you run out to your county recorder’s office to change your title right away, you should know that there are very serious ramifications to holding property this way. Find out more here. For our purposes, though, this property will not have to go through the probate process.

The second way to pass property is through a contract. Here, a “contract” is an agreement that you entered into with the custodians of your property. This contract is often referred to as a Beneficiary Designation, a Transfer on Death Designation, or a Payable on Death Designation. These are all basically contracts that you have made with financial institutions. You will entrust your assets with them to be invested, and in exchange, when you pass away, those assets will go to your loved ones. There are also serious limitations to passing your property this way, and you can find out more about this here. Again, for our purposes, this property will not have to go through the probate process.

Through Trust

If your loved one’s property is held in a trust, whether it is a revocable trust or an irrevocable trust, this property will not have to pass through the probate process. However, just because the trust document says the property is in the trust, that does not make it so. If the title to the property (deeds for houses, designations for other assets, etc.) does not say the property is in the trust, it is not in the trust. This is the preferred method to hold property, and for a discussion on this topic, go here. For our purposes, if the title of the property was transferred to the name of a trust, the property will not have to go through the probate process.

Through Estate

Finally, if the property was not passed in any of the above methods, the property is in the estate, which is the jurisdiction of the probate court.

My Loved One has very little property; Do I still have to go to Probate Court?

Maybe not. If your loved one had less than $160,000 in their gross estate, then you may be able to use a much less burdensome process than full formal probate. But you have to read that sentence again. The court is looking at GROSS estate. This means that the court pretends like your loved one has no debt (this includes mortgages). So, if you are thinking that your loved one had less than $160,000 because they had a $300,000 home with a $200,000 mortgage, you would be right that they have less than $160,000 in equity, but they have more than $160,000 in the gross estate because the gross estate is the fair market value of the house at the time that your loved one passed away.

How Can Working With a Probate Attorney Benefit Me?

During probate, the deceased person’s estate is assessed and their assets are distributed, debts are paid, and disputes are resolved. Going through this process can be complicated and overwhelming. Fortunately, you have the option of working with a probate attorney to help you navigate the experience. Here are some key advantages of working with an experienced professional:

● Experience: While the average person does not deal with estate planning or probate matters on a regular basis, probate attorneys specialize in this area of law. We have a deep understanding of the legal requirements, procedures, and deadlines involved throughout the process, allowing us to provide seasoned advice during every step so you can make informed decisions.

● Support: Dealing with logistics right after losing a loved one can be emotionally challenging. Working with a probate attorney can help alleviate some of the stress associated with estate administration so that you can focus on other things.

● Efficiency: The probate process can take a long time, but working with an attorney can help streamline the experience. We will make sure that all necessary steps are taken efficiently, file all paperwork on time, and address any delays to expedite the administration as much as possible. This can save you time and stress.

● Asset Protection: A probate attorney can help protect the estate’s assets from potential claims or disputes. We will help monitor the process to ensure that everything is valued correctly, all debts are paid, and the assets are distributed according to all applicable laws as well as the decedent’s wishes. This helps guard against legal challenges down the line. If disputes do arise, we can help resolve them.

Navigating the probate process can be overwhelming, but working with The Ashcraft Firm can make it easier. Contact us to schedule a consultation.

Here's a Visual Depiction of the Analysis we are Doing...

Great News! My Loved One had Under $160,000. What Now?

You never thought that you would be happy that your uncle left you so little. Jokes aside, if your loved one did leave less than $160,000, you can use what is called a small probate affidavit to get property from banks and other financial institutions. These institutions are sometimes hesitant to hand over the assets because all they have to go on is the affidavit, but legally, that is technically all you need. Click the PDF icon here to get the document for yourself.

How much does probate cost?

The probate code specifies how much an attorney can charge to take on a case like this. The amount is based on the value of the gross estate at the time your loved one passed. If you give a guess as to what the property would sell for, that will suffice to predict the amount the attorney will get paid. According to California Probate Code 10810, the attorney will be paid 4% of the first $100,000, or $4,000, to guide you through the probate process. Then, 3% of the next $100,000 of the estate or $3,000. Next, the code sets the fee at 2% up until you hit $1 million.

For example, your loved one owned a $500,000 home with a $400,000 mortgage on the property. Let’s say that this is the only piece of property that will have to be probated. The attorney will get paid as follows:

4% of the first $100,000 = $4,000

3% of the next $100,000 = $3,000

2% on the next $300,000 = $6,000

The total attorney fees = $13,000

This is not the end of the fees. If your case requires a professional executor, which happens fairly regularly in probate court, you can double the amount that is paid to the attorney. Now the total fee is $26,000. There may also be fees for securing a bond, which is also dependent upon the fair market value of the estate. Tack another $2,000-ish onto this for court fees, publication fees, etc. Now you have a case that will cost $28,000+ if no one fights. The problem with the court is that when someone gets into the court, they like to fight (I don't know if this is a result of the fact that Law and Order can be found on at least one station any time, day or night).

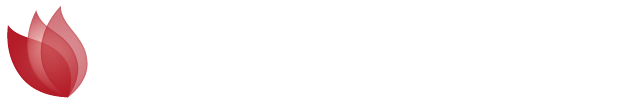

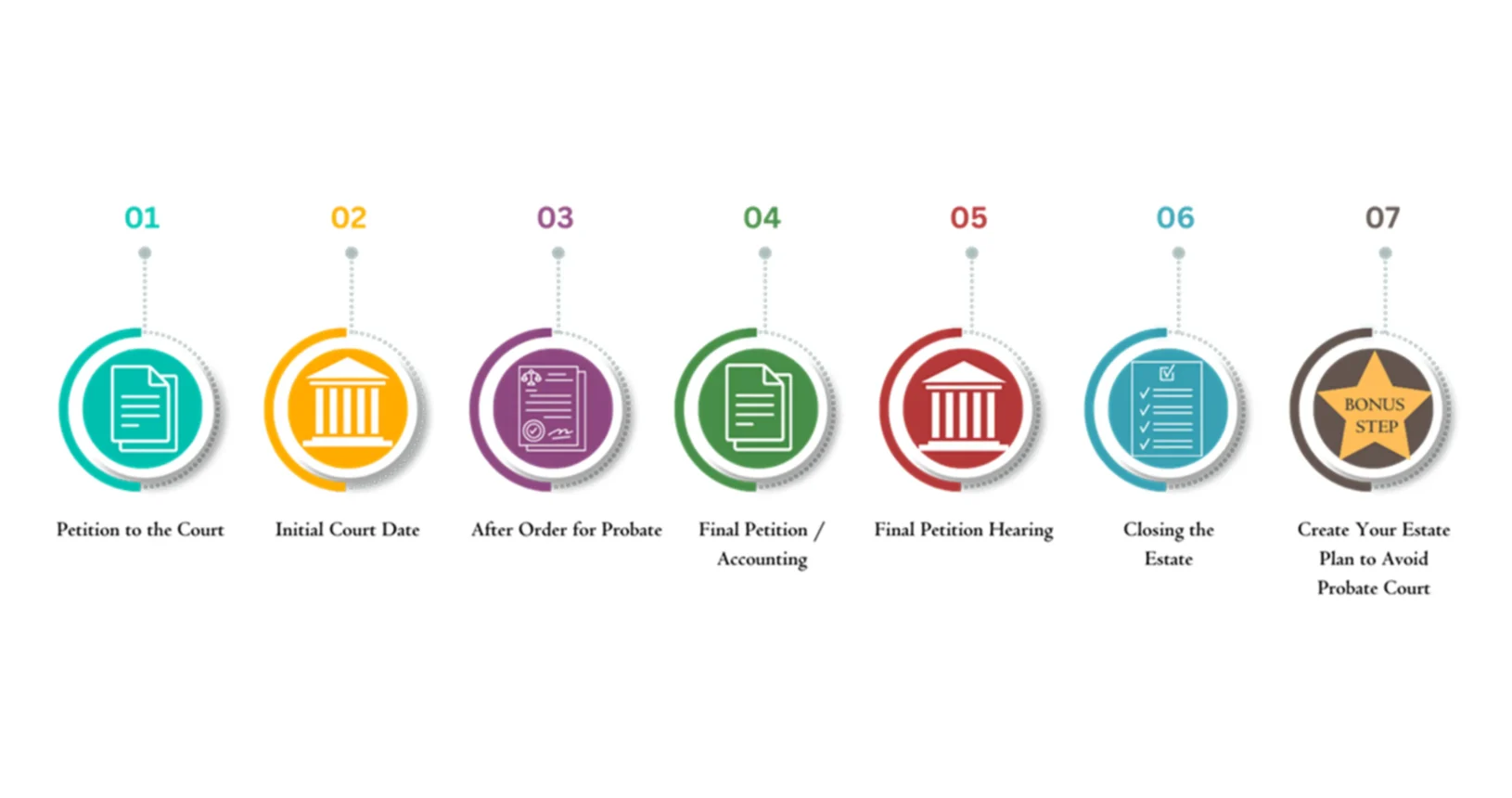

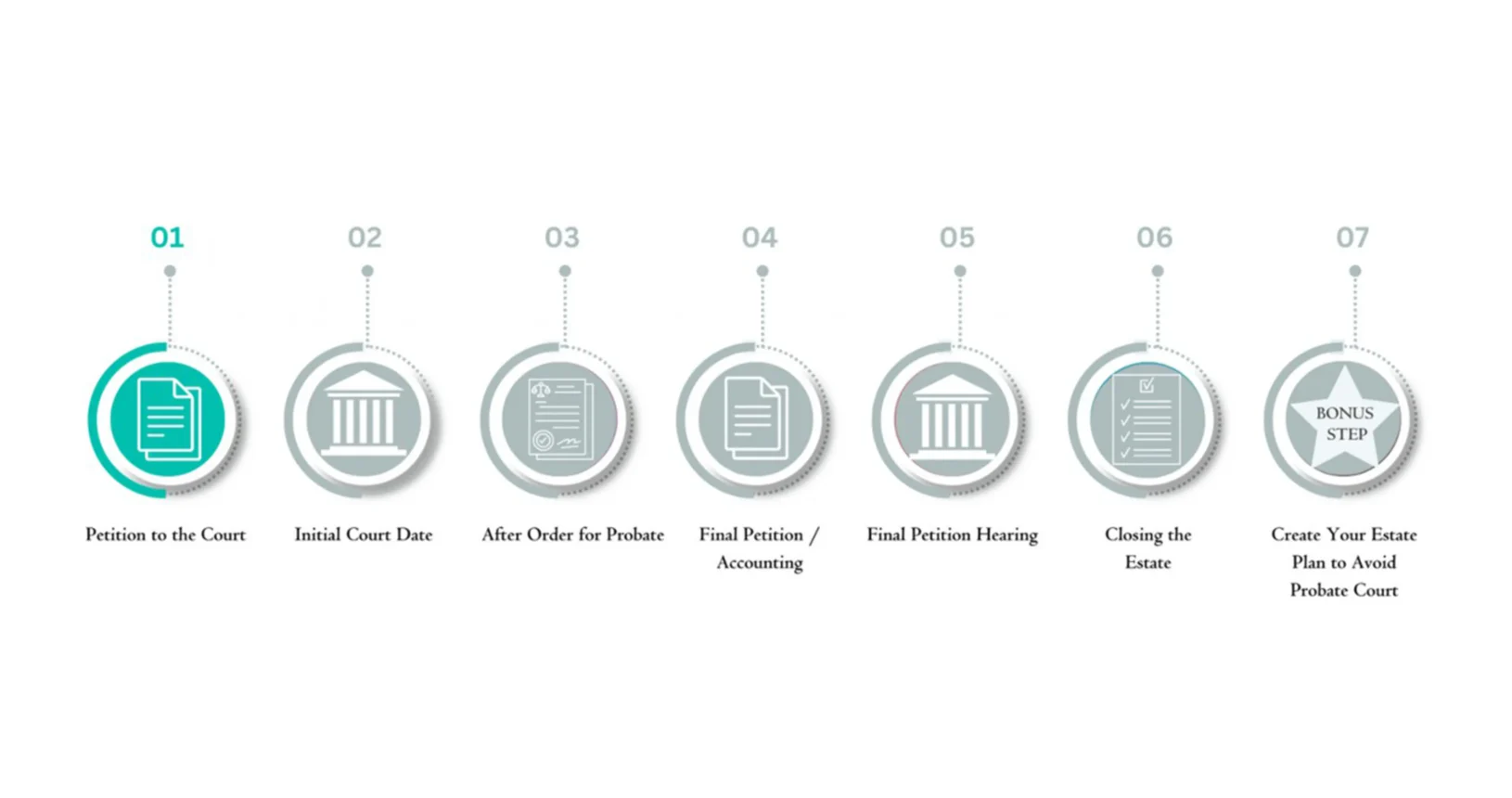

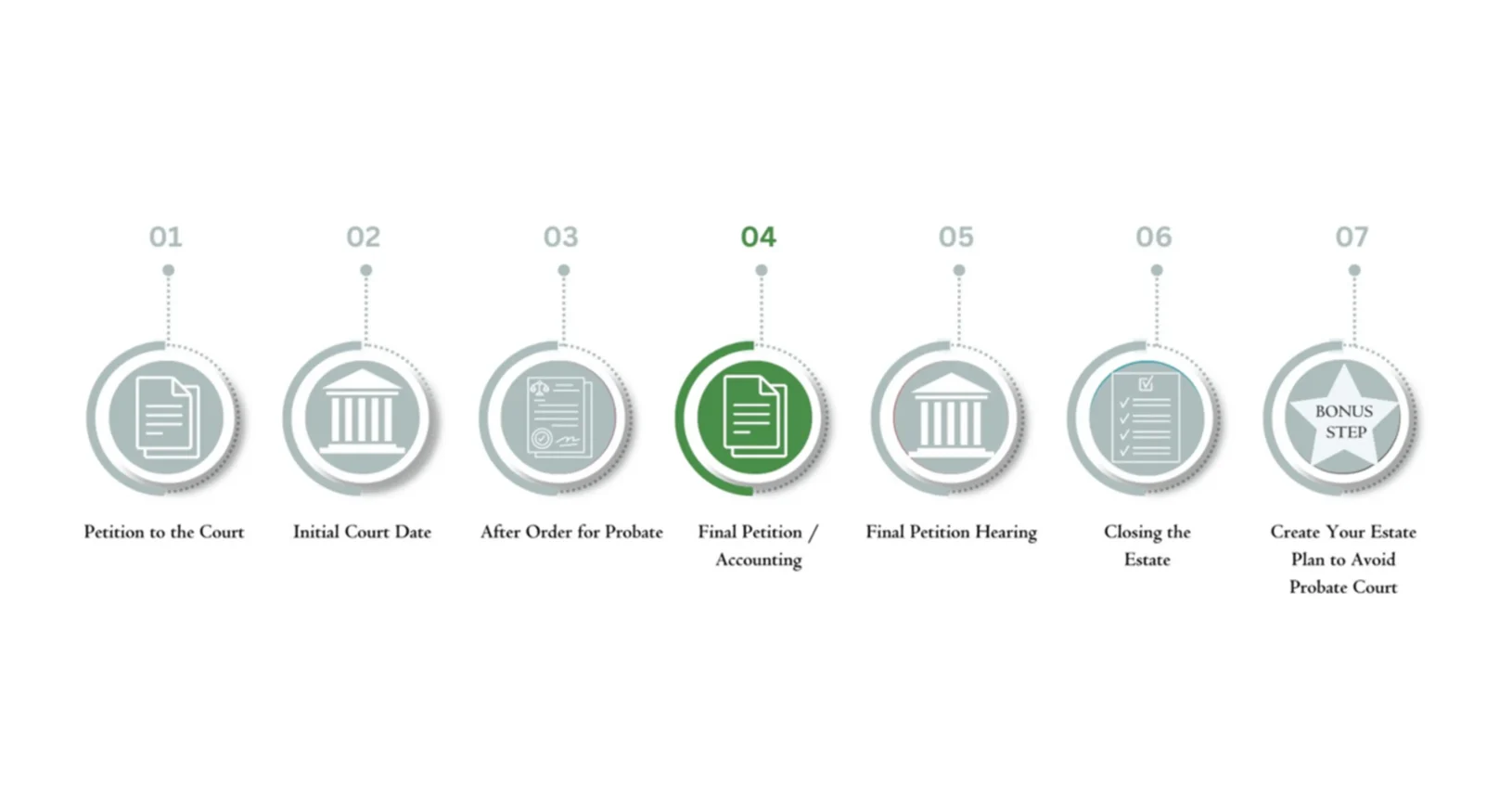

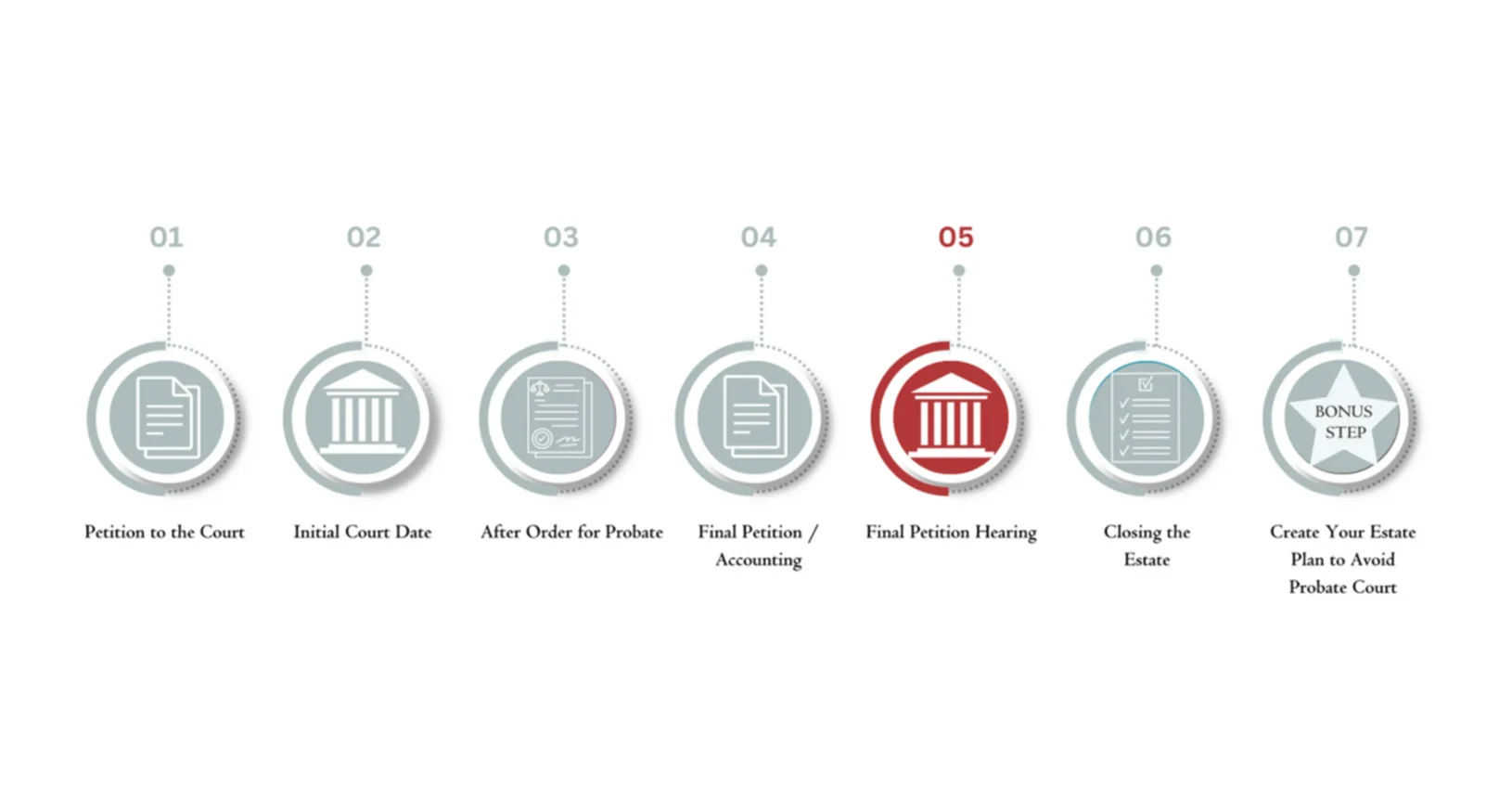

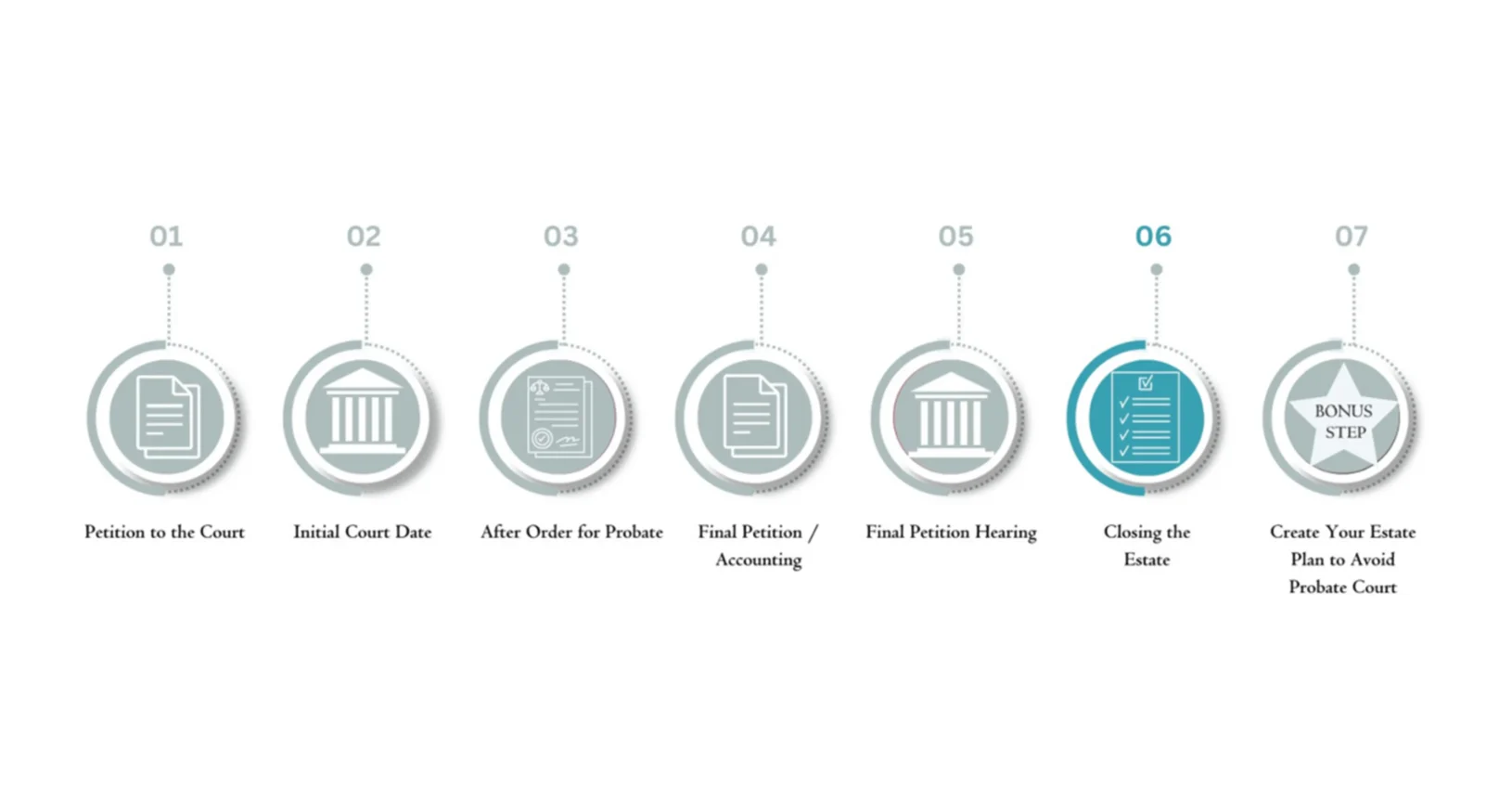

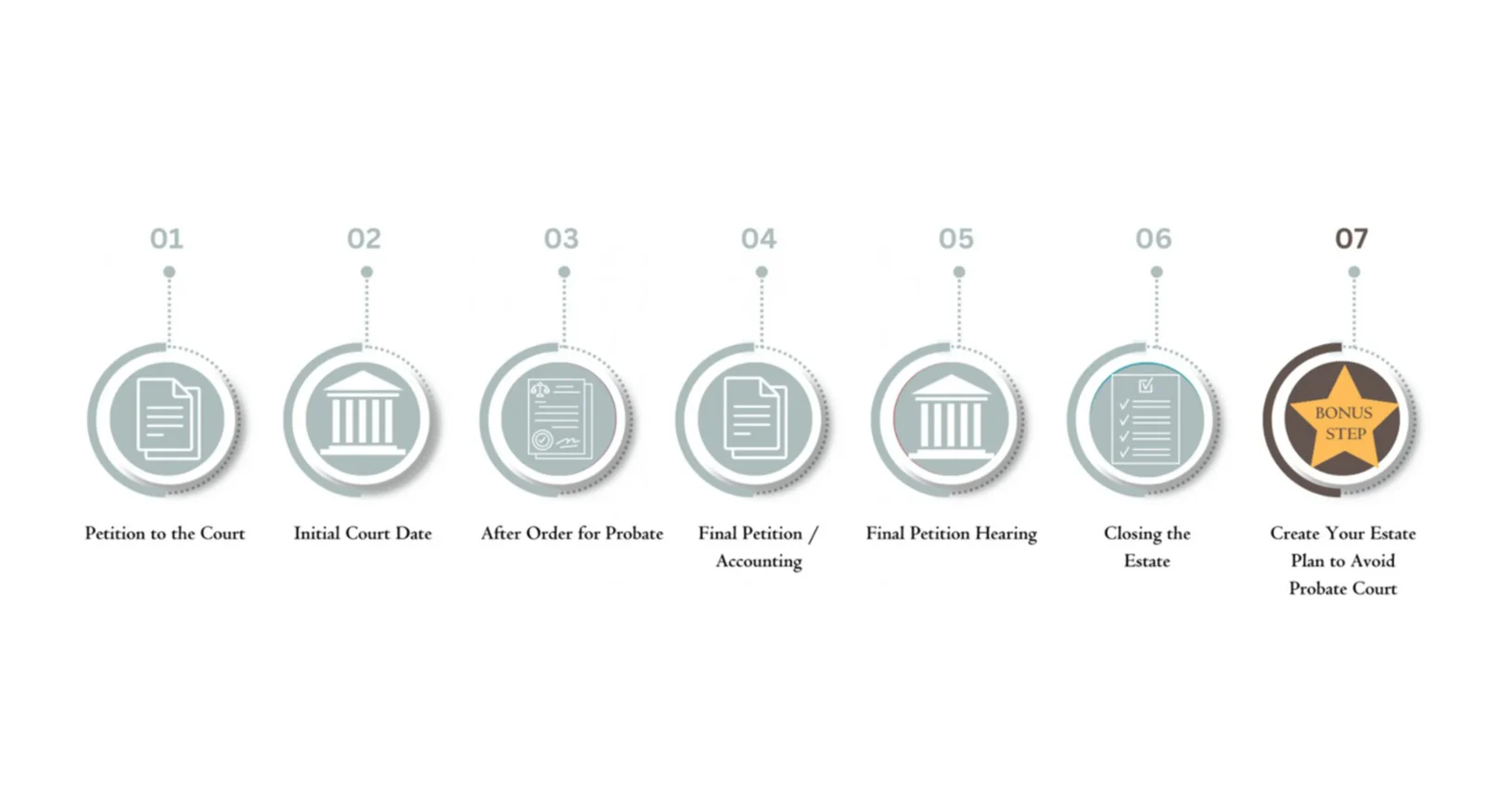

What are the stages of probate?

If no one fights, the full process can take anywhere between 9-12 months, depending on how backed up the court is. Riverside County Court is typically faster than, say, San Diego or Los Angeles County, but 9- 12 months is a good rough estimate. At our office, we break the process down into 6 distinct parts:

Contact Our Office in San Diego, CA or Murrieta, CA Today

The death of a loved one is a very stressful time. Most people don’t want to add the stress of taking on a difficult court process along with the stress of maneuvering with the loved one's financial life. This is why we, as a part of our pledge to create peace through the use of the law, have devoted a part of our practice to helping people through this difficult time. We do so with love, compassion, and understanding.

If you call our office in San Diego or Murrieta, you’ll find that we have caring staff and attorneys. For no obligation, we will help you begin to gather your loved one’s estate and have a consultation with you to discuss what to expect. Also, we take our statutory fees at the end of the case (in the Step 6: Distribute phase), so you do not have to pay attorney’s fees up front. Contact us today to learn more.