Your 2018 Estate Planning To-Do List: 4 Things to Do Before 2018 Ends

December 9, 2018

Do You have enough assets to need an estate plan?

January 10, 2019

You may know about the benefits of a traditional estate plan that includes a trust, will, power of attorney, and health care documents, but you may be unaware that this this mainly takes care of big picture decisions. The average estate plan should be updated maybe every 3 to 5 years, but in reality life changes faster than that. Most estate plans average 17 years when they are actually used (which is obviously too long to wait to update even your big picture plan). You can make your estate plan even more useful and make any changes in your life even smoother by implementing a micro estate plan strategy.

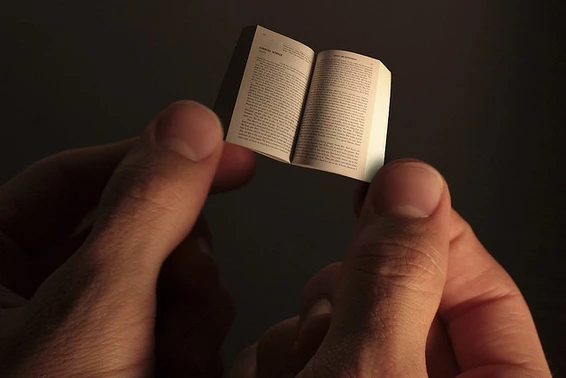

Micro estate planning employs short-term techniques rather than the long-term strategies represented by a traditional estate plan. These questions are more immediate and may also be more transient in nature changing year by year.

What is Micro Estate Planning?

Like I mentioned before, while a traditional estate plan focuses on the big picture, a micro estate plan focuses on what may happen in the next year. Short term needs that your micro estate plan may want to focus on can include vacations, temporary absences from work for surgeries or other family needs.

Are you expecting a new baby? This is the perfect thing to motivate you to do some short-term estate planning. Questions such as, “What if my spouse needs emergency medical services while the pregnancy is occurring? Do we have a plan for who will watch our other children? Do we have a plan for our pets while we are away? Will there be a gap in my pay because I am not working because of the new arrival?”

Other micro-estate planning may revolve around the always possible lack of employment in the short term or maybe even longer term, due to layoff or injury. You should ask yourself, “Do I have a plan should I become injured to the extent I can no longer work?” This may lead you to realize that you need income replacement plans.

Micro-planning can take care of more immediate needs than a traditional estate plan can. The traditional estate plan often takes a doctor’s determination that someone has lost mental capacity or may need a death certificate to active. A micro-estate plan is more immediate and flexible than this type of planning.

Contact us with any questions

Contact Us if you need legal documents drafted to support your long-term estate planning goals or your micro-estate plan. Also, if you need a referral to a professional who can provide you with income replacement insurance or other needs, we are just a phone call away.

It is the new year and you can make it your goal this year to have the emergency plans in place should something happen to you or your loved ones.